Tune in for our webinar to explore:

- How can insurers differentiate their customer experience in the complex world of insurance?

- How can Binah.ai help insurers reduce onboarding friction and make automated underwriting smarter?

- How can Binah.ai help insurers access client-provided health data to generate predictive insights, reduce health risks and help clients live healthier lives?

Your data will be kept and managed in Binah.ai systems in accordance with our Privacy Policy.

It's no secret that insurance evokes a range of negative emotions among the average consumer. How has insurance received this reputation? How can insurers improve their customer experience and even generate loyalty?

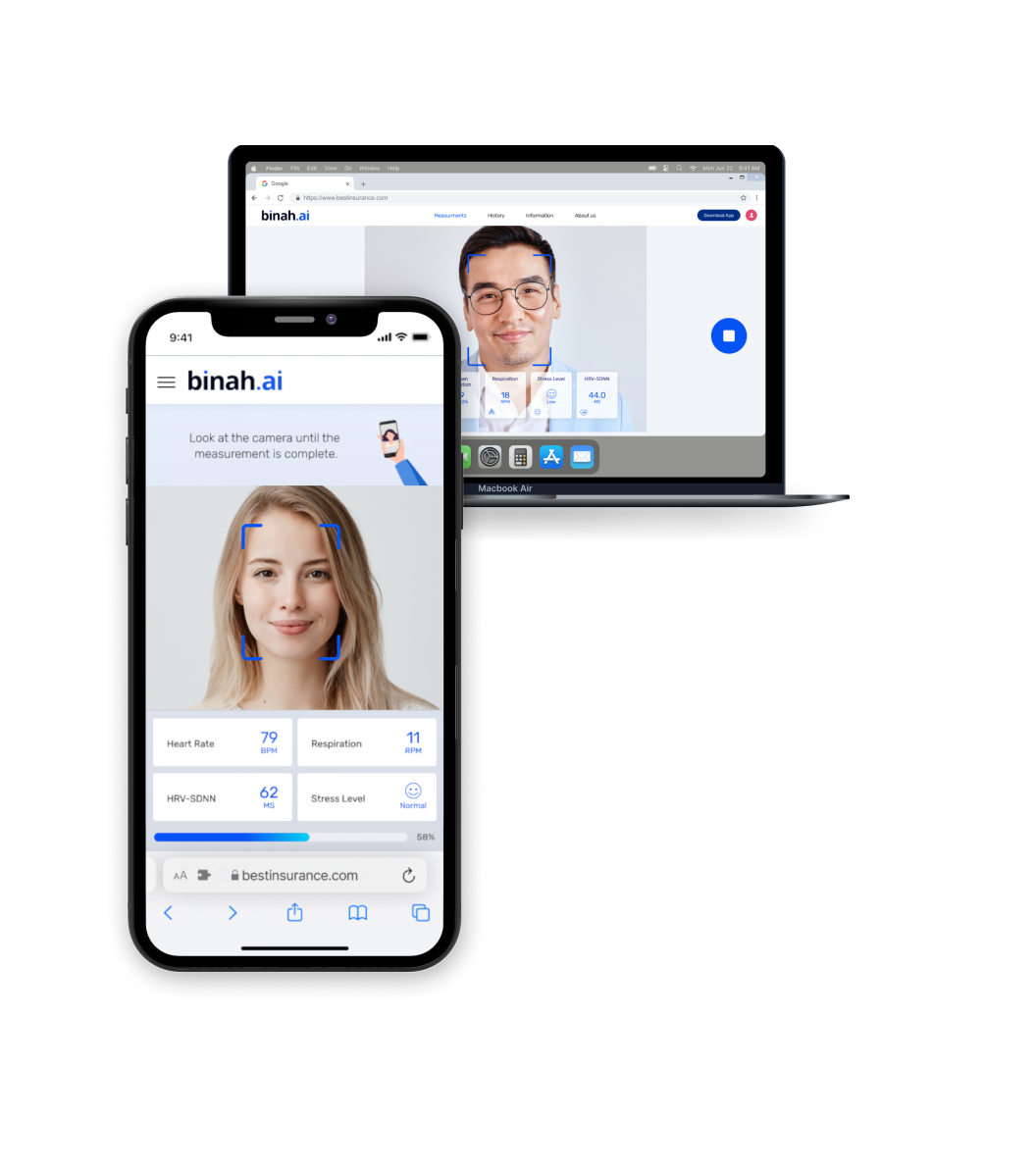

Tune in to learn how insurers can create a better customer experience by using real-time health and wellness monitoring from smartphone and laptop cameras to accelerate automated underwriting, empower clients with a preventive health tool, and enable them to easily share health data in exchange for predictive insights and personalized services.

Remotely Monitor Real-time Health Data

for a Better Customer Experience

Easy-to-use

Just by looking at the device's camera

No wearables needed

100%

software-based

Easy to Integrate

Available as SDK or end-to-end application platform

Always Accessible

Supports Google Chrome and Safari on desktops and mobile devices

For All

Supports any gender and skin color

Cost Saving

A cost-effective solution to remote wellness monitoring

Unique Mix of AI & Signal Processing

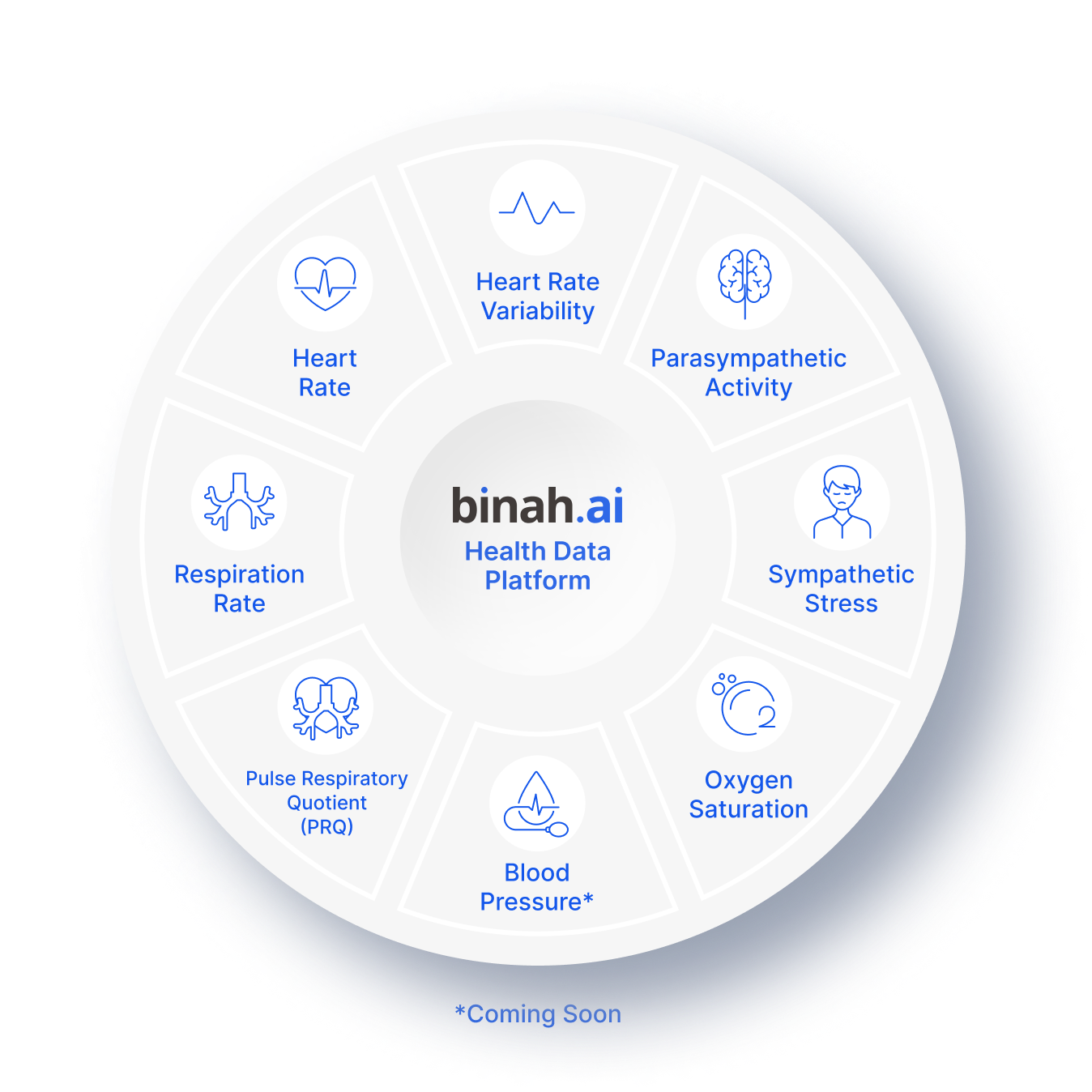

Remotely extract your client's real-time heart rate, heart rate variability (SDNN and/or RRi raw data), parasympathetic activity, sympathetic stress, oxygen saturation, respiration rate, pulse respiratory quotient, and soon blood pressure just by having them look at their personal smartphone, tablet or laptop camera. Anytime, anywhere.

Our Speaker

Alon Shem-Tov

VP of Business Development

and International Sales at Binah.ai,

Alon brings over 15 years of experience working in close contact some of the world's largest insurers.

Market Acclaimed Technology

.png)

.png)

.png)

.png)

.png)

.png)